I-Fast, Einaudi Center's economic indicator, continues to improve

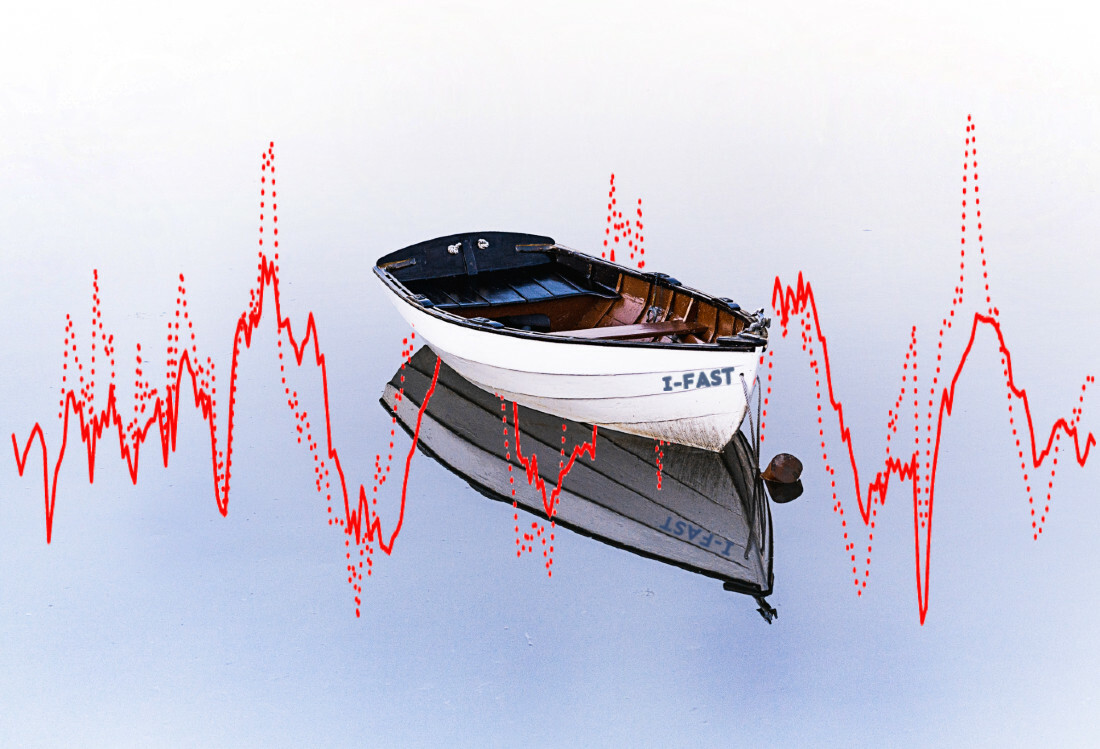

The Italian economy is not intimidated by two nearby wars and scores another small advance. The I-Fast indicator, which the Einaudi Center constructs based on frequently available time series, is progressing and heading toward the positive side of the graph. Recall how it is constructed: it aggregates the sentiment and expectations of Italian firms on a number of variables correlated with the future change in GDP. Its scale ranges from -3 times to +3 times the standard deviation of the aggregate from the 12-month moving average.

A positive value indicates better expectations and a better consensus than the average of the previous twelve months. As you can see in the figure, in the past I-Fast has shown ability to anticipate the future trend growth rates of Italian GDP. In the second quarter of 2022 I-Fast had fallen below the zero line, anticipating the decline of the short-term production cycle. Recall that in the second quarter of 2022 Italy had entered the energy crisis resulting from the war in Ukraine. The lowest point of the indicator was reached in the third quarter of 2023, which was followed by two quarters (the last of 2023 and the first of 2024) of strong recovery. The value now is 0, but compared to the same period in 2023, the improvement is 0.55 standard deviations, enough to suggest that not only has recession been averted, but also that recovery is, albeit painfully, underway.

Figure 1 - Synthetic cyclical I-Fast indicator (left scale) and trend percentage changes in Italian GDP (right scale)

But what kind of recovery are we talking about?

Looking inside the changes in some of the constituents of I-Fast, it is a recovery more in power than already fully expressed. In fact, the index concerning production levels have not moved upward, while orders, both of capital goods and consumer goods, and even orders from abroad have moved. Since orders precede production, we expect production indicators to turn upward in the coming months as well, and this should ensure that Italy will sail into 2024 with some margin of safety.

Figure 2 - Absolute cyclical changes (last quarter over the previous quarter) in some components of the I-Fast indicator. Scale indicates d.s. (standard deviations) from the annual moving average

The growth forecast for 2024 is very low. It could get better

The point is that on growth in the rate of change of GDP in 2024 there is no agreement even among forecasting institutions and the government. If 2023 ended with 1 percent expansion, how do you reconcile improving economic indicators with forecasts? All forecasts hover around the value of +0.7 percent, but that appears lower than the 2023 growth. Even Bankitalia forecasts an increase in the order of 0.6 percent in 2024, returning to +1.0 percent in 2025 and finally accelerating to 1.2 percent only in 2026.

However, many forecasters have been wrong in recent years, first exaggerating the stability of the 2022 recovery and then exaggerating the impact of rising interest rates in 2023. It has really become complicated to make forecasts because businesses have become much quicker to react to stimulus than in the past. This may be one key to understanding this. Secondly, we are perhaps underestimating some elements of the national economy that are playing out in an expansionary key, but are not fully understood.

Some factors in the resilience of the Italian economy

There is first and foremost the issue of employment. Not only have the number of employed people increased surprisingly, +362 milia from January 2023 to January 2024, but the employment rate has also increased. The percentage of employed workers is increasing and precarious (and independent) work is decreasing. It is true that if employment grows one and a half times GDP growth, you are adding jobs with decreasing productivity to the economy. This happens if the composition of new employment favours sectors in which productivity can grow little, structurally, such as tourism, but on the other hand, rising labour income still makes the economy more resilient to cyclical fluctuations.

There is secondly the issue of inventories. When growth rates are less than unity, the dynamics of inventories can determine the outcome. In 2023, inventories fell quite a bit. If there had been no decumulation of inventories, the change in Italian GDP in 2023 would have been +2.5 percentage points, not +1. The downward pressure on inventories of -1.5 points cannot be infinite because it has physical and financial limits. Therefore, the depletion of excess inventories will contribute to the expansion of production in 2024.

Global Competitiveness: Italy surpasses France and Germany in export purchasing power

Another quality, which has changed little by little, of the Italian economy is the competitiveness of exports, which are relatively less correlated with Central European demand and more globally distributed. In 2022, exports served to pay for higher-priced gas imports, without rooting macroeconomic progress in the trade balance. In 2023, on the other hand, net foreign demand contributed +0.3 points to GDP growth, and it is by no means certain that 2024 will mark a worsening. Note that in 2019, net foreign demand alone contributed half a percentage point of GDP growth. Now, this is not seen because of the expansion of import consumption, accelerated by the increase in employment, inflation, and also the expansionary fiscal policy of government budget.

Sooner or later precisely the latter will have to change, because the new rules of the European Stability Pact will result in the initiation of an excessive deficit procedure, almost certainly. When this happens, probably in 2025, export competitiveness may come in handy to offset the inevitable domestic fiscal tightening.

We close the reflection with this very reasoning. The indicator we suggest looking at is the real effective exchange rate, which expresses the imports that each country can buy with its exports. Italy with a value of 98 outperforms both France and Germany by 13 points, even though it shares the European fate of a tendentially slow deterioration in terms of trade due to its energy dependence on imported primary sources. However, the purchasing power of Italian exports is better than that of Europe's locomotives, and this is not a volatile phenomenon, but the consequence of a structural improvement in competitiveness, albeit limited to sectors open to international trade.

The Italian economy continues to be plagued by numerous structural problems, while the economy is proving to be more solid than expected, even if it is not only the virtues we have described that are fueling it, but also the excessive public deficit, which Istat has certified in 2023 as 7.2 percent of GDP. About two points above the programmed one (5.3%) and which after the European elections will have to be curbed in one way or another.

Figure 3 - Indices of real effective exchange rates, average exchange rates weighted by foreign trade flows and adjusted for the relative level of consumer prices.

© Riproduzione riservata