The return to a “zero point” growth of the Italian GDP in 2024 is considered the baseline by both the government and the statistical and forecasting institutes. However, as in 2023, surprises may also be possible in 2024, month by month, perhaps as a result of changes in the international context. To take this into account and follow the economic cycle throughout 2024, the Centro Einaudi has created the I-FAST index. It now signals a kind of "calm", that is consistent with the hypothesis of “zero point” growth, but it will change 12 times during the year and we will publish it to promptly inform our readers of the accelerations and decelerations of the Italian business cycle. The “zero point” growth is not enough to provide the basis for the solution of the country's structural problems, from the huge public debt, to the financing of the pension system and families addressed new welfare state to the growth of real wages after their post pandemic devaluation.

2023 went worse than expected

In January of last year, Istat estimated the probable growth of GDP in real terms in 2023 at 1.2 percent. We will know at the end of January 2024 the preliminary estimate of the entire 2023, but main forecasters agree in judging it lower than the baseline, from +0.4% of Confindustria to +0.6% of the Bank of Italy.

In 2024, the Istat baseline (updated in December 2023) should be +0.7%, but as we have already seen in 2023, things could either get worse, but also better. How could we follow the monthly performance of a final figure that is cumulated on an annual basis?

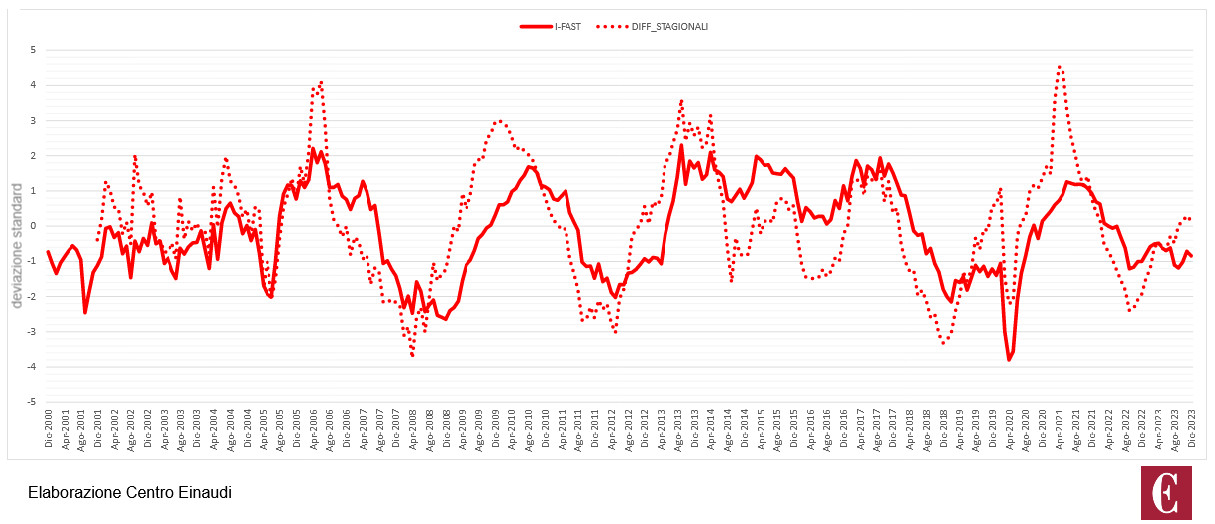

We suggest to our readers to follow the release of a new index by the Einaudi Center. The new index is called I-FAST; it stands for Italian-fast and accurate statistical tracker. In practice, I-FAST follows month by month the dynamics of 9 variables sensitive to the economic cycle, printing out a monthly figure, equal to the number of standard deviations from the aggregate average of the last 24 months. This means that if I-FAST is higher than zero, then the economy is accelerating compared to the average of the last two years. If, on the other hand, I-FAST is lower than zero, the economy is decelerating.

The I-FAST index, as can be seen from figure 1, is reactive to the cyclical trend of the economy. According to I-FAST, the negative peak of the pandemic recession was reached in April 2020 (with a value of -3.8 s.d. compared to the 24-month average). But it should be noted that at the end of 2019 things were not going particularly well for the Italian economy, since I-FAST had already fallen into negative territory (-1 s.d.). In June 2021, the post-pandemic recovery had reached its typical speed, which it managed to maintain until October 2021 (+1.2 s.d.). It should be noted that according to the I-FAST index, the return to a “zero-point” growth was not a "surprise" of 2023, because I-FAST had invaded the negative territory more or less in June 2022, and in September 2022 it was already at -1.2 s.d., making it reasonable that the growth of 2023 would not have been up to the expectations of consensus, normally influenced by the most recent period.

How will 2024 go, in economic terms?

The I-FAST value for December 2023 was still in negative territory (-0.84 s.d.), but the index was progressing in seasonal terms (i.e. in terms of difference from the same month of past year), for about a year, which could mean that the "growth consumption" could have run out.

However, there is a difference between a growth process that stops worsening and a path that starts improving: the Italian case can be classified in the first case, not in the second, for now.

Looking inside the I-FAST indicator, the elementary indicators in greater progress are those that mark the reduction of inflation, the lower tension on interest rates and the related improvement of liquidity conditions. On the other hand, both domestic consumption and instrumental investments weigh on the negative side.

In the first half of 2023 families have spent the savings they had built up in their bank accounts during the pandemic, either because they could not spend them before, or because they got them from the government. In the second half, households had to deal with the reduction of the purchasing power of their income; in particular, the wage-earners slowed down the spending dynamics because their real unit wages, on average, lowered and have not yet recovered the previous levels. As for corporate investments, their planning has been negatively impacted not only by the increase in interest rates due to monetary policy, but also by uncertainty. Companies had to face a more uncertain context not only economically, but also in technological and geopolitical terms and, probably, they are slowing down investments waiting for horizon clearings, not enough evident at the moment.

For these reasons, the Italian economic cycle has fallen back into the old "zero point" path. I-FAST will help us to distinguish, during the current year, the possible accelerations or decelerations of the Italian business cycle.

Is "Zero point" growth enough?

Observing the short-term business cycle will become increasingly important, from now on. The Italian economy will indeed have to face the problem of controlling its public finances, reducing its public debt in terms of GDP, if not from today, from 2025, when the freshly signed European "stability and growth pact" will enter into the application and Italy will risk ending up in the so-called "corrective arm". Secondly, the aging of the population and the increase in the fragility of young families, also remembered by the Mr Mattarella, in his inaugural speech on January 1st, will generate an increase in demand for both pension benefits and innovative welfare state services. Thirdly, the issue of wage dynamics and the stagnation of real wages are a concrete emergency, which even the minimum wage could not have remedied, if it had been introduced. To address these challenges, the only effective strategy is a sustained, sustainable, much larger than “zero point” GDP growth path. To drive the GDP up in these terms, the "real" growth of GDP should be driven by the increase in the average labour productivity and in the total factor productivity: both (especially the second) have been starving in the last twenty years or, rather, they have substantially risen only in the narrow cluster of medium-sized internationalized companies, which produce from 5 to 10 percent of GDP. In the European plans, the compulsory ongoing reforms related to the PNRR should trigger the qualitative change of the economic growth process, so as to progressively abandon the path of "zero point". In fact, the latter cannot solve for its small size the three big structural troubles of Italy. If they were to grow without being solved by a larger GDP, in the medium term we will find Italy downgraded in an uncomfortable corner of the G20.

Thanks to I-FAST, we will keep readers updated on Italy’s monthly advances in enhancing its economic growth process.

© Riproduzione riservata