The recently published June 2025 update of ISTAT’s regional economic accounts provided a valuable opportunity to examine, sector by sector, the state of development in the traditionally lagging Southern Italy.

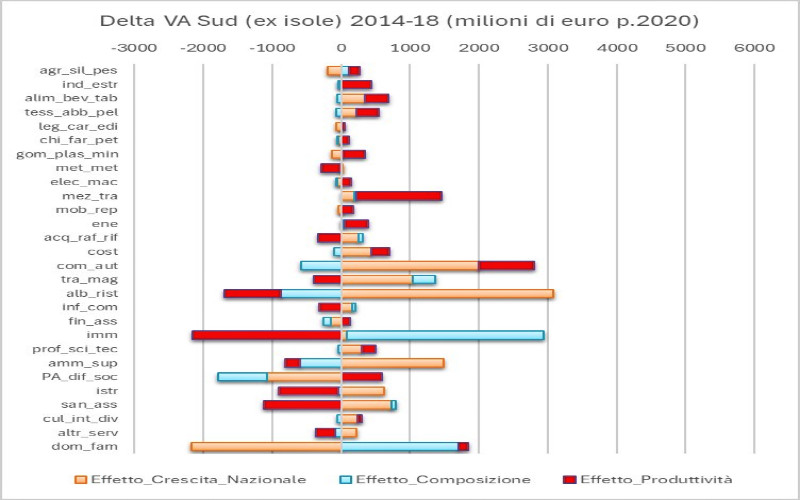

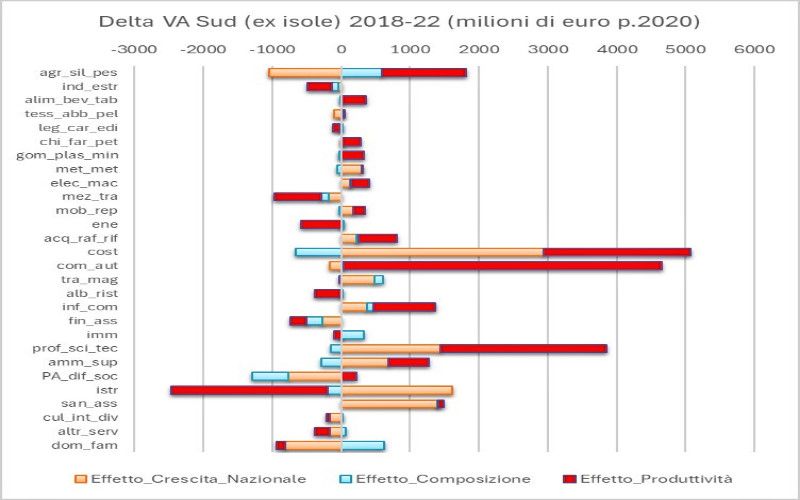

The shift-share analysis applied to Southern Italy (excluding the islands) clearly highlights how macro-regional growth stems from the interplay of three distinct drivers: the inertia of general trends that propel all territories, the sectoral composition reflecting local productive vocations, and the internal productivity dynamics of each sector, which depend on the ability to innovate and compete. This breakdown is not a mere academic exercise but a practical tool to identify the strengths and weaknesses of the southern system, distinguishing what moves “by the force of gravity” from the genuine energy of businesses, thus guiding targeted industrial policy interventions—for instance, selecting sectors to support or restructure. The results of the latest temporal comparison reveal a profound metamorphosis: some sectors have ridden the wave of the global context, while others, despite competitive advantages, have lost ground due to structurally weak drivers. This varied and at times contradictory mosaic of performances paints a dynamic picture that now, more than ever, requires policies tailored to the southern productive fabric.

We conducted the shift-share analysis on data from the 2014-2022 period. The first surprise concerns overall performance: while in the 2014-2018 quinquennium value-added growth was relatively modest (+8,531.4 million, with a concerning negative productivity effect of -907.2 million), the 2018-2022 period shows significant acceleration (+14,807.1 million), driven this time by a robust productivity effect (+9,003.95 million). The growth rates for the two periods were 3.59% and 6.02%, respectively. This overturns the stereotyped image of a perpetually lagging South, revealing instead an unexpected recovery capacity in the second period, particularly significant when compared to the performance of other areas of the country.

The transportation equipment sector offers a paradigmatic case of this transformation. In the first period, it contributed significantly to growth (+1,231.96 million, 14.44% of the total), with a productivity per worker effect responsible for a 33.39% increase in value added relative to the base. However, in the second period, it plummets to -682.53 million (-4.61% of the total), with the productivity effect marking -13.27%. This dramatic reversal may reflect not only the crisis in traditional component manufacturing but also the failure of new sustainable mobility chains to take root in the South, despite substantial national incentives.

Meanwhile, the construction sector shows a remarkable leap: from a contribution of just 266.78 million (3.13%) in the first period to 2,119.51 million (14.31%) in the second. This boom, with the productivity per worker effect rising from +2.19% to +16.56% of the base value added, seems tied more to the season of construction bonuses than to a genuine sector recovery, raising questions about the sustainability of this growth.

The analysis also reveals an unexpected vitality in the southern agricultural sector. While in 2014-2018 it showed modest performance (+156.93 million, +1.84% of the total), in the subsequent period, it triples its contribution (+1,213.58 million, +8.2%), with the productivity per worker impact jumping from +2.04% to +15.59% of the base value added. This often-overlooked data in macro analyses suggests that the much-touted “agro-food revolution” in the South may finally be underway, possibly driven by growing demand for typical products and precision agriculture.

The food manufacturing sector also shows positive dynamics.

Particularly interesting is the case of the information and communication technology (ICT) sector, which in the South displays a performance diametrically opposed to the national trend. After a concerning decline in the productivity effect (-312.98 million, -3.67% of the total) in the first period, the second period marks a vigorous recovery (+884.12 million, +5.97%), with the productivity per worker impact shifting from -6.55% to +18.92% of the base value added. This could indicate that the digital divide in the South is starting to narrow, perhaps due to the spread of smart working and the return of digital skills to southern regions.

The hospitality and catering sector deserves special attention. In 2014-2018, it showed a negative productivity effect (-818.83 million, -9.6% of the total), despite the national tourism boom. Surprisingly, in 2018-2022, the situation worsens further (-370.23 million, -2.5%), with productivity per worker dropping from -8.52% to -3.37% of the base value added. These data debunk the common notion of a South riding the wave of national tourism growth, revealing instead a structural weakness in the sector, likely tied to the prevalence of low-productivity micro-enterprises.The southern productive system also shows increasing polarization.

On one hand, sectors like professional and scientific services double their contribution to growth (from +199.57 million to +2,406.93 million), with the productivity per worker impact soaring from +1.62% to +18.87% of the base value added. On the other hand, traditional sectors like metallurgy continue to struggle (-284.08 million in the first period, +26.19 million in the second), with stagnant productivity per worker (from -7.91% to +0.79% of the base value added).

This divergence suggests the emergence of an internal dualism in the South, with some chains integrating into advanced value chains while others remain trapped in obsolete models.A particularly significant finding concerns the energy sector, which in the South shows a performance opposite to the national trend. While in 2014-2018 it contributed positively (+345.39 million, +4.05% of the total), in the subsequent period, it collapses to -582.15 million (-3.93%), with the productivity per worker impact plummeting from +17.96% to -25.15% of the base value added. This may reflect the difficulties of traditional large-scale power plants in the South, not offset by the development of renewables, despite the region’s potential.

The analysis of the composition effect offers further original insights. While in 2014-2018 it was positive (+1,881.07 million, +22.05% of the total), in the subsequent period, it turns negative (-299.55 million, -2.02%), signaling that the South’s productive specialization is unfortunately becoming less effective in the national context.

This reversal is particularly evident in the real estate sector, where the composition effect drops from +2,847.35 million to +313.78 million, suggesting that the South’s traditional construction-driven engine is losing steam.The case of health and social care is emblematic of the South’s contradictions: after a heavy negative productivity effect (-1,113.64 million, -13.05% of the total) in the first period, the second period shows a timid recovery (+65.6 million, +0.44%), with productivity per worker shifting from -5.91% to +0.35% of the base value added. This may reflect improvements in service organization, given that the value added of public services is calculated at their production cost.In conclusion, the economy of Southern Italy is undergoing a complex and non-linear transformation, with unexpected sectors emerging as new growth engines (agro-food, ICT, professional services), while some traditional pillars (transportation, construction) show more apparent than real vitality. Tourism also contributes far less to GDP formation than the professional sector, a fact that should be considered when tourism is suggested as a panacea for local development. It often masks a lack of ideas and strategies.

The real challenge for the South will not be so much catching up with the North but consolidating emerging sectors while modernizing traditional ones, avoiding the risk of dangerous internal polarization. The data suggest that the South may be nearing a turning point, but policies based on numbers, not impressions, are needed to seize this opportunity.

© Riproduzione riservata